2026 Medicare Changes: What the 1.5% Premium Adjustment Means

The 2026 Medicare changes will introduce a 1.5% premium adjustment, directly impacting beneficiaries' budgets and requiring proactive financial planning to navigate evolving healthcare costs effectively.

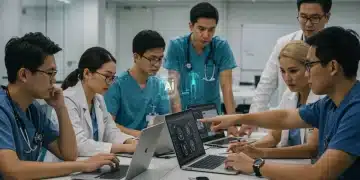

Upskilling in AI & ML for Healthcare: 3-Month Roadmap 2026

This 3-month learning roadmap for 2026 provides a strategic guide for professionals seeking to upskill in AI and Machine Learning within the healthcare sector, outlining essential modules and practical applications to foster career growth.

Maximize Employer Benefits 2026: Your 3-Month Action Plan

This guide provides a strategic 3-month action plan for 2026 to help employees in the US effectively understand, optimize, and fully utilize their employer-sponsored benefits, covering health, financial, and professional growth opportunities.

U.S. Healthcare Cybersecurity Threats Surge 25%: Patient Data at Risk

Recent findings indicate a significant 25% increase in U.S. healthcare cybersecurity threats within the last quarter, posing substantial risks to patient data integrity and privacy. This surge demands urgent attention and fortified defense strategies.

Maximize Your HSA in 2025: An Insider’s Guide to $8,300 Savings

Maximizing HSA contributions 2025 allows individuals and families to save significantly on healthcare costs and build tax-advantaged wealth, with potential savings reaching $8,300 through strategic planning and understanding eligibility requirements.

Mastering MedTech Certifications: 5 Essential Programs for 2025

Mastering MedTech Certifications: 5 Essential Programs for Career Advancement in 2025 offers a strategic roadmap for professionals seeking to elevate their expertise and market value within the rapidly evolving medical technology sector.

Navigating 2025 Medicare Changes: Part B Premiums & New Coverage

The 2025 Medicare changes will significantly impact beneficiaries, particularly concerning Part B premium adjustments and the introduction of new coverage options designed to enhance healthcare access and affordability.

Major Pharma Acquires U.S. MedTech Startup for $1.2 Billion: Key Updates

A significant development in the healthcare industry sees a major pharmaceutical company acquiring a leading U.S. MedTech startup for $1.2 billion, signaling strategic shifts and potential advancements in medical technology and patient care.

MedTech Innovators: Optimize Your 401(k) for Retirement by 2025

For MedTech innovators, optimizing your 401(k) by 2025 is crucial for a secure retirement. This guide details five key strategies, from maximizing contributions to strategic asset allocation, ensuring your financial future is robust and aligned with your innovative career path.

2025 Child Tax Credit: Eligibility, Benefits, and Maximizing Your Claim

The 2025 Child Tax Credit introduces significant changes to eligibility and benefit amounts, allowing many American families to claim up to $2,000 per child by understanding the new requirements and strategic planning.