2025 Social Security COLA: Impact of Projected 3% Increase

The projected 3% Cost-of-Living Adjustment (COLA) for 2025 is anticipated to directly influence monthly Social Security benefit payments, impacting retirees’ purchasing power and financial stability.

As we look ahead, understanding the 2025 Social Security Cost-of-Living Adjustment (COLA): How a Projected 3% Increase Impacts Your Monthly Benefit Payments is crucial for millions of Americans who rely on these funds. This anticipated adjustment directly influences the financial well-being of retirees, disabled individuals, and other beneficiaries across the nation.

Understanding the COLA Mechanism

The Cost-of-Living Adjustment, or COLA, is a vital mechanism designed to help Social Security and Supplemental Security Income (SSI) benefits keep pace with inflation. Without COLA, the purchasing power of benefits would erode over time, making it harder for beneficiaries to afford essential goods and services. This annual adjustment aims to maintain the real value of these payments, ensuring that those who depend on them can continue to meet their living expenses.

The Social Security Administration (SSA) determines the COLA based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Specifically, they compare the average CPI-W for the third quarter of the current year (July, August, and September) with the average for the third quarter of the previous year. The percentage increase, if any, between these two periods becomes the COLA for the following year. This calculation method is legally defined and ensures a consistent approach to benefit adjustments.

How the CPI-W Influences COLA

The CPI-W is a specific measure of inflation that tracks the prices of a basket of goods and services typically purchased by urban wage earners and clerical workers. This includes items such as food, housing, transportation, medical care, and other necessities. Because it focuses on this particular demographic, it is considered a relevant indicator for the cost-of-living changes experienced by many Social Security beneficiaries.

- Food Costs: Changes in grocery prices and dining out significantly affect the CPI-W.

- Housing Expenses: Rent and homeowner costs, including utilities, are heavily weighted.

- Medical Care: Prescription drugs, doctor visits, and health insurance premiums are key components.

- Transportation: Fuel prices and public transit fares play a role in the index’s fluctuations.

When the CPI-W rises, it indicates that the cost of living has increased, triggering a COLA to help beneficiaries offset these higher expenses. Conversely, if the CPI-W shows no increase or a decrease, there will be no COLA for that year, though a decrease in the CPI-W does not lead to a reduction in benefits.

In essence, the COLA serves as a financial safeguard, helping to protect beneficiaries from the impacts of inflation. It is not intended to increase real income but rather to preserve existing purchasing power. Understanding this fundamental mechanism is the first step in appreciating the significance of any projected adjustment, such as the anticipated 3% increase for 2025.

The Projected 3% Increase for 2025

Recent projections suggest that the 2025 Social Security Cost-of-Living Adjustment (COLA) could be around 3%. This forecast is based on current inflation trends and economic indicators, particularly the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). While this is still a projection and not a final determination, it provides an important glimpse into what beneficiaries might expect in the coming year. The official announcement typically occurs in October, after the third-quarter CPI-W data becomes available.

A 3% increase, if realized, would represent a notable adjustment, especially when compared to some historical COLA figures. It reflects persistent inflationary pressures that have been impacting the economy. For millions of Americans, this percentage translates directly into an increase in their monthly Social Security checks, offering some relief against rising costs of living.

Comparison with Recent COLA Adjustments

To put the projected 3% into perspective, it’s helpful to look at recent COLA history. The past few years have seen significant fluctuations:

- 2023 COLA: 8.7% – One of the largest increases in decades, driven by high inflation.

- 2024 COLA: 3.2% – A more moderate increase, reflecting a slight moderation in inflation.

- 2025 Projected COLA: 3% – Suggests a continued, albeit slower, rate of inflation.

These figures highlight the dynamic nature of COLA adjustments, which are directly tied to economic conditions. The 2023 spike was largely a response to the rapid rise in prices following the pandemic, while the subsequent adjustments indicate a gradual return to more typical inflation levels. The projected 3% for 2025 suggests that while inflation may not be as rampant as in 2022, it remains a factor that necessitates benefit adjustments.

While a 3% increase might seem modest compared to the 8.7% of 2023, it is still a positive adjustment that helps maintain beneficiaries’ purchasing power. It is crucial for individuals to understand that this projection is an estimate and the final figure could vary slightly. However, it provides a valuable benchmark for financial planning and understanding the potential impact on monthly benefit payments.

Direct Impact on Monthly Benefit Payments

For millions of Social Security beneficiaries, a projected 3% Cost-of-Living Adjustment (COLA) for 2025 directly translates into an increase in their monthly checks. This adjustment is applied uniformly across all types of Social Security benefits, including retirement, disability, and survivor benefits. The specific monetary increase will depend on an individual’s current benefit amount, as the 3% is calculated based on their existing payment.

For example, if a beneficiary currently receives $1,800 per month, a 3% COLA would add an extra $54 to their monthly payment, bringing it to $1,854. While this might seem like a modest increase for some, for others, particularly those on fixed incomes or with limited savings, every additional dollar can make a significant difference in covering daily expenses and maintaining financial stability. This direct impact on monthly payments is the most tangible benefit of a COLA.

Calculating Your Potential Increase

To estimate your potential increase, simply multiply your current monthly Social Security benefit by the projected COLA percentage. For a 3% increase, the calculation is straightforward:

- Current Monthly Benefit x 0.03 = Estimated Monthly Increase

- Current Monthly Benefit + Estimated Monthly Increase = New Monthly Benefit

It’s important to remember that this calculation is based on the projected 3% and the final COLA could be slightly different. However, this method provides a reliable estimate for planning purposes. Beneficiaries should also consider that while their gross benefit increases, other factors like Medicare Part B premiums can also change, potentially affecting their net payment.

The increase in monthly benefits has several implications. It can help offset rising costs for essentials like groceries, utilities, and healthcare. For some, it might mean the difference between struggling to make ends meet and having a bit more breathing room financially. For others, it could allow for small discretionary spending or contribute to savings. The direct effect on monthly payments underscores the importance of the COLA in preserving the economic security of Social Security recipients.

Broader Economic Implications of COLA

Beyond individual benefit checks, the Social Security Cost-of-Living Adjustment (COLA) has broader economic implications that ripple through the U.S. economy. When millions of beneficiaries receive increased payments, it injects additional capital into various sectors, influencing consumer spending, local economies, and even national inflation rates. This widespread impact makes COLA more than just a personal financial adjustment; it’s an economic event with significant macroeconomic consequences.

Increased Social Security payments can stimulate consumer demand. Beneficiaries, particularly those with lower incomes, tend to spend a larger portion of their additional funds on essential goods and services. This heightened demand can support businesses, from grocery stores to healthcare providers, and contribute to overall economic activity. In local communities with a high concentration of retirees, the impact can be particularly noticeable, boosting retail sales and service industries.

Impact on Inflation and Consumer Spending

While COLA is designed to combat inflation, a substantial increase in benefits can, to some extent, also contribute to inflationary pressures. When more money circulates in the economy, especially if supply remains constant, it can lead to higher prices. However, the Social Security Administration’s method of calculating COLA, which is backward-looking, means that the adjustment is a response to past inflation rather than a direct driver of future inflation.

- Increased demand: More disposable income for beneficiaries can lead to higher demand for goods and services.

- Local economic boost: Small businesses in retirement communities often see increased sales.

- Offsetting price increases: COLA helps beneficiaries maintain purchasing power against rising costs.

- Fiscal considerations: Larger COLA payments mean increased outflows from the Social Security trust funds.

Furthermore, the COLA also has implications for the Social Security trust funds. Larger COLA increases mean greater outflows from the system, which can accelerate the depletion of the trust funds if not balanced by sufficient inflows from payroll taxes. Policymakers closely monitor these trends, as the long-term solvency of Social Security is a perennial concern. The interplay between inflation, COLA, and the financial health of the Social Security system is a complex one, requiring careful management and consideration.

In summary, the COLA is a multifaceted economic tool. While its primary purpose is to protect beneficiaries’ purchasing power, its ripple effects extend throughout the economy, influencing consumer behavior, supporting local businesses, and playing a role in the broader fiscal landscape of the nation.

Planning for Your Financial Future with COLA

For Social Security beneficiaries, understanding the projected 2025 COLA and its implications is a critical component of effective financial planning. While the adjustment aims to preserve purchasing power, it’s essential to integrate this information into a comprehensive financial strategy. Relying solely on COLA increases may not be sufficient to cover all rising costs, especially in areas like healthcare, which often outpace general inflation.

Beneficiaries should review their current budget and compare it with anticipated income, including the projected COLA increase. This allows for a clear understanding of how the adjustment will affect their overall financial picture. Identifying areas where costs might still exceed the COLA increase can help in making necessary adjustments to spending or seeking additional income sources.

Strategies for Maximizing Your Benefits

Beyond the COLA, there are several strategies beneficiaries can employ to maximize their financial well-being:

- Delaying Benefits: For those who can afford it, delaying Social Security benefits past their full retirement age can result in higher monthly payments.

- Working in Retirement: Even part-time work can supplement income, reduce reliance on Social Security, and potentially increase future benefits if earnings are high enough.

- Managing Healthcare Costs: Researching Medicare Advantage plans, prescription drug plans, and understanding out-of-pocket expenses can save significant amounts.

- Budgeting and Savings: Creating a detailed budget and maintaining an emergency fund are crucial for financial resilience.

It’s also important to consider how Social Security benefits interact with other sources of retirement income, such as pensions, 401(k)s, and IRAs. A holistic approach to financial planning ensures that all income streams are optimized and that beneficiaries are prepared for unexpected expenses or prolonged periods of high inflation. Consulting with a financial advisor can provide personalized guidance and help in developing a robust financial plan that accounts for COLA and other economic factors.

Ultimately, the COLA is a valuable tool in maintaining the real value of Social Security benefits. However, it should be viewed as one piece of a larger financial puzzle. Proactive planning, informed decision-making, and a comprehensive understanding of all income and expense streams are vital for securing a stable and comfortable financial future.

Potential Challenges and Considerations

While a projected 3% COLA for 2025 is generally positive news for Social Security beneficiaries, it’s important to acknowledge potential challenges and considerations that can impact its real-world effect. The COLA is designed to keep pace with inflation, but not all expenses rise at the same rate, and individual spending patterns vary significantly. This can lead to situations where the COLA might not fully cover the increases in a beneficiary’s most critical costs.

One primary concern is the rising cost of healthcare. Medical expenses, including prescription drugs, insurance premiums, and out-of-pocket costs, have historically outpaced general inflation. Even with a COLA, many beneficiaries find that a significant portion of their increase is absorbed by higher healthcare costs, particularly Medicare Part B premiums, which are often deducted directly from Social Security checks. This can diminish the perceived benefit of the COLA.

Medicare Part B Premiums and Net Benefits

Medicare Part B premiums are a critical factor that can offset COLA increases. These premiums, which cover doctor visits and outpatient care, are subject to their own annual adjustments. In years where Medicare Part B premiums rise significantly, they can consume a substantial portion, or even all, of a beneficiary’s COLA increase, resulting in little to no net gain in their monthly take-home benefit.

- Premium Deductions: Medicare Part B premiums are typically deducted directly from Social Security benefits.

- Income-Related Monthly Adjustment Amounts (IRMAA): Higher-income beneficiaries may pay higher Medicare premiums, further impacting their net benefits.

- Healthcare Inflation: Medical costs often increase faster than general consumer prices, reducing the real value of COLA.

- Individual Spending Habits: COLA’s effectiveness varies based on personal expenditure priorities and choices.

Another consideration is the specific CPI-W index used for COLA calculation. While it’s designed to reflect the spending patterns of urban wage earners, critics argue that it may not fully capture the unique expenditure patterns of seniors, who often spend more on healthcare and less on transportation or education. This disconnect can lead to a COLA that doesn’t perfectly align with the actual cost-of-living increases experienced by many elderly beneficiaries.

Therefore, while the 2025 COLA is a welcome adjustment, beneficiaries should remain vigilant about their personal finances. Understanding how healthcare costs and other specific expenses interact with their increased benefits is crucial for assessing the true impact of the adjustment and for making informed financial decisions.

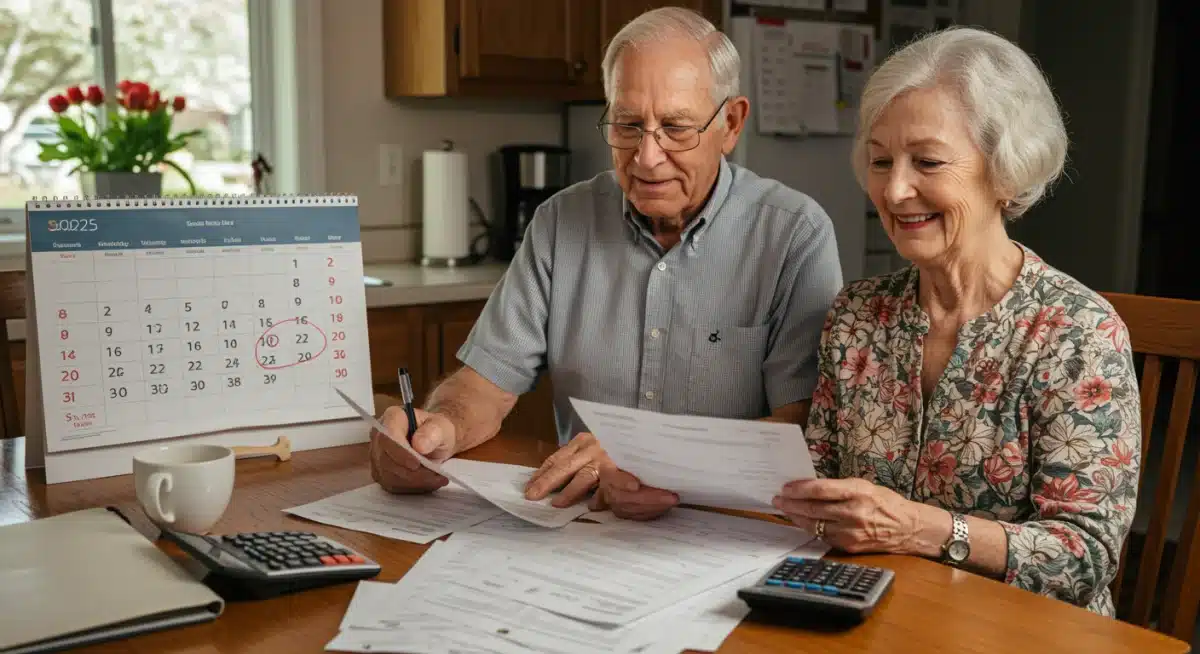

The Official COLA Announcement and What Comes Next

The projected 3% Social Security Cost-of-Living Adjustment (COLA) for 2025, while widely discussed, remains an estimate until the official announcement from the Social Security Administration (SSA). This critical announcement typically occurs in October of the preceding year, after the release of the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) data for the third quarter (July, August, September). This data is the final piece of the puzzle that allows the SSA to calculate and declare the exact COLA percentage.

Once the official COLA is announced, the SSA will begin the process of adjusting benefit payments. This involves updating their systems and notifying beneficiaries of their new monthly amounts. This notification usually comes in the form of letters mailed to beneficiaries in late November or early December, detailing their new benefit amount and any changes to Medicare premiums that might affect their net payment.

Receiving Your Updated Benefits

The new COLA-adjusted benefit payments typically take effect in January of the following year. For most beneficiaries, this means their first increased payment will be received in January 2025. It’s important for individuals to keep an eye out for their official notification letter from the SSA, as it will contain the precise details of their adjusted benefits.

- October Announcement: The official COLA percentage is typically announced.

- November/December Letters: Beneficiaries receive official notification letters from the SSA.

- January Payments: Increased benefit payments reflecting the new COLA begin.

- Online Access: Information on new benefit amounts will also be available through My Social Security accounts.

Beneficiaries are encouraged to create or log into their My Social Security account online. This secure portal provides access to their benefit statements, payment history, and other important information. It’s often the fastest way to view their new benefit amount once it has been processed. Additionally, staying informed through reliable news sources and the official SSA website can help beneficiaries prepare for the upcoming changes.

In conclusion, while projections offer valuable insights, the official COLA announcement is the definitive moment. Beneficiaries should mark their calendars for October and prepare to receive their official notifications, ensuring they are fully aware of how the 2025 COLA will impact their monthly Social Security payments beginning in January.

| Key Aspect | Brief Description |

|---|---|

| COLA Purpose | Adjusts Social Security benefits to keep pace with inflation, preserving purchasing power. |

| 2025 Projection | Anticipated 3% increase based on current economic indicators and CPI-W trends. |

| Impact on Benefits | Directly increases monthly payments for retirees, disabled, and survivors by the COLA percentage. |

| Key Consideration | Medicare Part B premiums can offset COLA gains, affecting net benefit payments. |

Frequently Asked Questions About 2025 COLA

The COLA, or Cost-of-Living Adjustment, ensures that Social Security and SSI benefits maintain their purchasing power against inflation. It helps beneficiaries afford essential goods and services as prices rise over time, preventing the erosion of their fixed income.

The 2025 COLA is calculated by comparing the average Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) for the third quarter of 2024 to the third quarter of 2023. The percentage increase determines the COLA.

The Social Security Administration (SSA) typically announces the official COLA for the upcoming year in October, after the final third-quarter CPI-W data has been released and analyzed. This is when the exact percentage is confirmed.

A 3% COLA means your monthly Social Security benefit will increase by 3%. For example, if you currently receive $1,500, your payment would increase by $45, bringing your new monthly benefit to $1,545.

Yes, Medicare Part B premiums are often deducted directly from Social Security benefits. If these premiums increase significantly, they can offset some or all of your COLA increase, impacting your net monthly payment.

Conclusion

The projected 3% Cost-of-Living Adjustment (COLA) for 2025 represents a critical factor for millions of Social Security beneficiaries across the United States. While still an estimate, this anticipated increase underscores the ongoing efforts to ensure that benefit payments keep pace with inflationary pressures, thereby preserving the purchasing power of retirees, disabled individuals, and survivors. Understanding the COLA mechanism, its calculation based on the CPI-W, and its direct impact on monthly checks is essential for informed financial planning. Despite the positive outlook of an increase, beneficiaries must also consider broader economic implications and the potential offsets from rising expenses, particularly Medicare Part B premiums. As the official announcement approaches in October, staying informed and integrating this information into a comprehensive financial strategy will empower beneficiaries to navigate their financial future with greater confidence and security.